| Date | Data / Event | Previous | Consensus |

| 7-Jun-22 | Australia interest rate decision | 0.35% | 0.60% |

| 7-Jun-22 | US trade balance (Apr) (Apr) | US$-109.8B | US$-89.3B |

| 8-Jun-22 | Australia business confidence (May) | 10 | NA |

| 9-Jun-22 | Europe interest rate decision | 0% | 0% |

| 9-Jun-22 | US core inflation y/y (May) | 6.2% | 5.9% |

| 10-Jun-22 | China inflation y/y (May) | 2.1% | NA |

| 10-Jun-22 | US consumer sentiment (Jun) | 58.4 | 58.2 |

Source: Bloomberg, UBS Global Research, Tradingeconomics.com

| Australia | US | Europe |

|---|---|---|

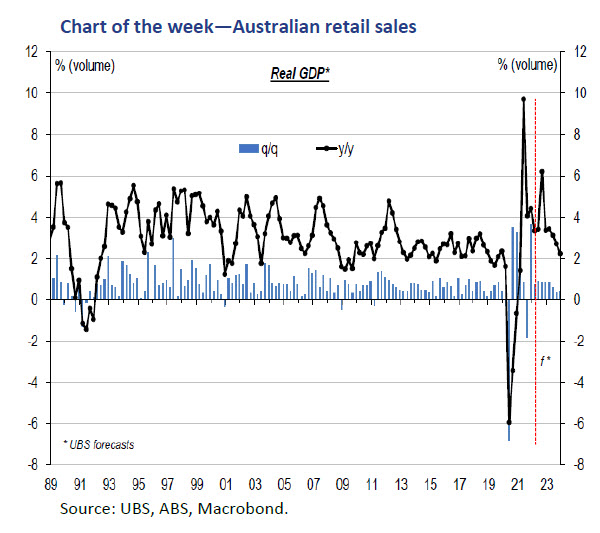

Domestic data was mixed last week, with the building approvals and home loans series both underperforming expectations while private credit held up well April. GDP data (see chart of the week) was in line with the consensus expectation immediately before the release, but only following downgrades on the back of weaker partial data prints in the build-up. The RBA meets this week and is expected to hike rates by 0.25% according to market consensus. While the near-term outlook is almost certain to see ongoing rate hikes, there is less clarity on the end point for cash rates. Market pricing suggests that ongoing hikes will see interest rates above 3% in the second half of 2023, but most researchers are expecting the RBA to pause well before that level is reached. For example, UBS and CBA both expect the RBA to stop hiking next year when the cash rate hits 1.60%. The business survey is the only other key domestic highlight in the week ahead. | The April non-farm payroll report showed stronger than expected gains over the month, although the level of that strength continued its downward trend. The unemployment rate held at near decade lows of 3.6%. Wage growth slowed again, with the annual average hourly earnings number declining from 5.5% to 5.2%. Overall, the report was solid, and while it won’t deter the Fed from making 0.50% hikes at coming meetings, the decline in wage growth will provide some comfort.

| European inflation surprised to the high side in May with the annual number hitting a record high of 8.1%, up from 7.4% in April and above the 7.7% consensus. The core series was also higher than expected, showing that price rises were driven by broader influences than solely energy gains. Retail sales was weaker than expected, declining 1.3% in April. The European Central Banks (ECB) has followed global peers by taking steps in hawkish direction in recent months. Another step towards rate hikes is expected at the meeting this week, with the ECB expected to announce the end of asset purchases, paving the way for a rate hike in July. As the year progresses UBS expects further hikes in September and December, with another four hikes in 2023. Unlike Australia, market pricing for European interest rates sees a lower terminal rate for the hiking cycle, with cash rates only forecast to hit 1.50% by the end of 2024. |

The Australian economy expanded by 0.8% in Q1, broadly in line with market expectations after a number of weaker than expected partial data prints over the prior week. The annual number moderated from an upwardly revised 4.4% to a still solid 3.3%. The data showed that demand remains strong and although consumption moderated from the re-opening boom, it posted a solid 1.5% quarterly gain.

Within the data, services consumption outstripped goods spending, which is a key part of the rationale for declining inflation in the second half of the year. Lower than expected wage growth also showed that wages remain contained for the time being.

Looking ahead, UBS has further downgraded its 2022 growth forecasts from 4.6% to 4.1%, with Q1 proving weaker than initially expected (prior to the underwhelming partials) and the impact of weather, Covid and supply chain disruptions likely to prove a drag on Q2 growth.

| INDICATOR | As at 03-Jun-22 | 1 WEEK CHANGE | 1 YEAR CHANGE | 3 YEAR CHANGE (ANNUALISED) | 5 YEAR CHANGE (ANNUALISED) |

| EQUITIES | % | % | % | % | |

| S&P/ASX 200 Accum. Index | 85,350.74 | 0.79 | 3.31 | 8.06 | 9.14 |

| US S&P 500 TR^ Index | 8,665.80 | 1.31 | -1.47 | 14.95 | 13.09 |

| Europe STOXX TR Index | 895.00 | -0.73 | -4.74 | 7.31 | 4.13 |

| UK FTSE 100 TR Index | 7,600.62 | 0.29 | 10.10 | 5.49 | 3.90 |

| Japan TOPIX TR Index | 2,927.83 | 2.51 | 0.67 | 10.42 | 5.96 |

| MSCI World ex-Australia TR Index | 6,570.73 | -0.71 | -2.62 | 12.04 | 9.83 |

| FIXED INCOME | % | BP | BP | BP | BP |

| Australian 90 day bank bill yield | 1.24 | 10.65 | 120.53 | -5.50 | -9.92 |

| Australian 10 year bond yield | 3.48 | 22.90 | 181.90 | 65.44 | 21.35 |

| US 90 day bank bill yield | 1.12 | 8.85 | 110.91 | -38.90 | 3.70 |

| US 10 year bond yield | 2.93 | 19.54 | 130.82 | 28.66 | 15.43 |

| UK 10 year bond yield | 2.16 | 24.50 | 132.90 | 42.12 | 21.55 |

| German 10 year bond yield | 1.27 | 31.00 | 145.60 | 48.89 | 19.90 |

| COMMODITIES | % | % | % | % | |

| Gold | 1,851.19 | -0.14 | -1.05 | 11.78 | 7.67 |

| Oil West Texas Crude | 118.87 | 4.19 | 72.75 | 30.69 | 20.06 |

| Iron Ore Spot Price Index | 146.50 | 9.66 | -28.75 | 14.54 | 21.49 |

| CURRENCIES% | % | % | % | % | |

| AUD:USD | 0.72 | 0.63 | -5.89 | 1.09 | -0.64 |

| EUR:USD | 1.07 | -0.15 | -11.61 | -1.57 | -1.01 |

| GBP:USD | 1.25 | -1.13 | -11.47 | -0.47 | -0.63 |

| USD:JPY | 130.88 | 2.97 | 18.67 | 6.59 | 3.46 |

| NZD:USD | 0.65 | -0.34 | -8.90 | -0.45 | -1.84 |

| CHF:USD | 1.04 | -0.56 | -6.14 | 1.03 | -0.00 |

| AUD:EUR | 0.67 | 0.79 | 6.49 | 2.71 | 0.01 |

| AUD:GBP | 0.58 | 1.78 | 6.30 | 1.56 | -0.01 |

| AUD:JPY | 94.31 | 3.62 | 11.63 | 7.75 | 2.79 |

*BP = Basis Point, Source: Bloomberg; ^TR = Total return.

IMPORTANT NOTE This document has been prepared by Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (Crestone Wealth Management). The information contained in this document is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it.

Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document. This document has been authorised for distribution in Australia only. It is intended for the use of Crestone Wealth Management clients and may not be distributed or reproduced without consent. © Crestone Wealth Management Limited 2022.