In this month’s letter, we look at the concept of a vintage year in private equity and venture capital funds and explain why diversifying across vintage years is important for investors. We also analyse the current environment for private market valuations and explain why it is important to stay true to strategic asset allocations and avoid timing the markets.

The pitfalls of predicting vintage performance

There are many factors that need to be managed when producing a fine wine—weather, geography and the condition of the soil. Similarly, for private equity, market conditions (including public market valuations), sector, geography and investment stage may determine how successful a fund from a given vintage year will be.

In this month’s letter, we look at the concept of a vintage year in private equity and venture capital funds and explain why diversifying across vintage years is important for investors. We also analyse the current environment for private market valuations and explain why it is important to stay true to strategic asset allocations and avoid timing the markets.

Why the wine analogy? What do we mean by vintage?

Private market investment strategies are typically delivered in closed-end funds, which (unlike open-end funds that are typically used to invest in public equities and fixed income) have a fixed or closed-end term. The term is normally 10 years, with potential extensions subject to investor approvals. Investors commit to invest a specific amount in the fund, and during the early years, capital is called into the fund and invested in portfolio companies as opportunities arise. As underlying portfolio companies mature and are sold, capital is distributed to investors. The key difference with closed-end funds is this drawdown and subsequent return of capital throughout the fund term, which is in stark contrast to an open-end fund where investors are fully invested on day one and remain fully invested until they decide to redeem.

So, to the wine analogy…each fund is launched on a given year or ‘vintage year’. The performance of a fund vintage is dependent on the prevailing market conditions over the coming years. Like wine, the quality of the vintage can be heavily impacted by the quality of the opportunity set (e.g. soil conditions) during the investment or drawdown period, and the quality of the environment (e.g. weather) during the harvest period, which is when companies are sold and returns distributed. It’s hard to predict whether a particular wine or fund vintage will be a success or not. We can’t predict the weather, just as we can’t predict or time the market.

So, why is it important to diversify across vintage?

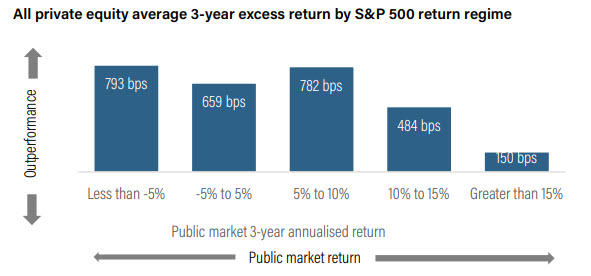

As implied above, and as we have written about previously in Market timing— re-examining the pitfalls, although timing the market is not impossible, it is very difficult. Analysis from UBS (based on the S&P 500 index) found that since 1928, an investor who was able to consistently exit the market 10 months prior to the peak, and then re-enter 10 months after the trough, was no better off than an investor who had simply stayed the course. And that doesn’t factor in trading costs and tax implications.

A fund vintage can take multiple years to invest

While the equivalent private market analysis does not exist given the nature of how returns are calculated, timing private markets is just as hard and arguably requires even more foresight. This is because a fund vintage can take multiple years to invest (or deploy committed capital), which means that investors would need to not only have a view on current market conditions, but also on conditions next year, the year after, and potentially beyond, depending on the length of the investment (drawdown) period for the fund.

Fund vintages can perform contrary to expectations

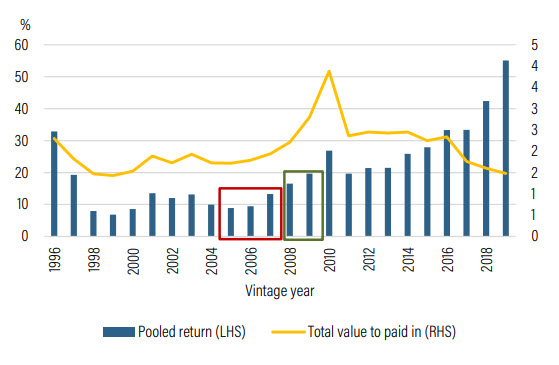

As shown in the chart below, which displays US fund vintage year returns through the cycle and includes both tech-bubble and GFC periods, fund vintages in the two to three years prior to major public market downturns fared far worse than those during the key problem years, notably 2008 and 2009. This is due to those funds being fully invested (with investors capital fully called) at the point when the market turned. Conversely, some of the best performing funds that have been raised have been considered ‘top-of-market’ funds. This is because a fund raised just before a market downturn has a large amount of capital available to invest (as valuations decline), but few investments are actually made prior to the market top. It is, therefore, easy to imagine a scenario where an investor may commit heavily into 2005-2007 vintage funds, where the market is seemingly strong, and then refrain from committing capital to 2008 and 2009 vintages where greater concerns arise. The result of trying to time the market in this way is that an investor may be exposed to some of the worst vintages (2005-2007) whilst missing out on some of the best (2008 and 2009).

Supply and demand can dry up in periods of market turmoil

A further complication is raised by Michael Lukin at Roc Partners: “Generally, in a crisis market environment, no new funds are raised as managers are focused on their core portfolio and demand for new investments dries up as LPs [Limited Partners] are generally more cautious and/or overallocated. This makes timing even more difficult in private relative to public markets”. It is for these reasons that it is important to avoid timing the market and to diversify across vintage—or maintain vintage-year continuity over the long term. KKR goes so far as to say that that vintage-year continuity can actually contribute more to returns than manager selection due to the variations of returns across vintages. And according to Prequin data, on average, there is a range of returns of more than 26% across vintages.

US private equity and venture capital since inception—internal rates of return and multiples by fund vintage year.

Source: Cambridge Associates. Based on data compiled from 2,796 US private equity and venture capital funds, including fully liquidated partnerships formed between 1996 and 2019. Internal rates of returns are net of fees, expenses and carried interest.

On average, private market valuations are expensive and on par with record levels at 11.6x in the US, 10.8x in Europe.

Are valuations likely to fall soon?

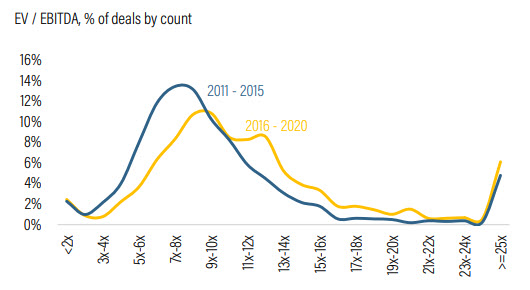

According to analysis from Hamilton Lane, on average, private market valuations are expensive and on par with record level multiples at 11.6x in the US and 10.8x in Europe. However, it is important to note that data in private markets is somewhat delayed, so this does not incorporate the strong returns from Q4 2021 and the turbulent returns from Q1. Record multiples have been particularly pronounced in high quality deals, as we have seen in public equities in recent years. Value deals are becoming increasingly hard to find as deal flow has trended toward more growth-orientated acquisitions. This trend is depicted in the following chart, which shows how purchase price multiples have shifted from 2011 through 2020.

Distribution of buyout deal purchase price multiples Source: Hamilton Lane Data, January 2022.

Source: Hamilton Lane Data, January 2022.

Sentiment across global fund managers suggests that pricing is unlikely to fall soon, owing to the market’s greater focus on ‘growthier’ assets and the continuation of favourable debt capital markets.

And while speaking of debt, leverage multiples have also been elevated in recent years (around 4.8x across US and Europe), supporting higher asset prices—but the ability for buyouts to service that debt is the highest it’s been in 20 years, notwithstanding recent accelerated expectations for interest rate hikes. As in the broader economy, while there’s significant uncertainty as to how high borrowing costs may rise over coming years, corporate and consumer balance sheets are in relatively strong positions.

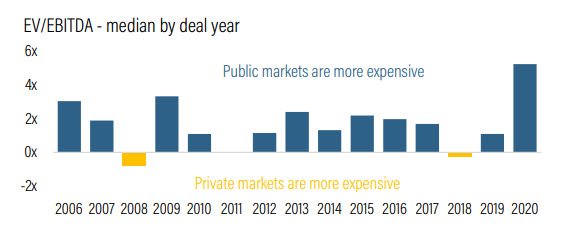

When comparing to public equity markets, as of Q3 2021:

As always, we advocate staying true to strategic asset allocations across asset classes, including both public and private markets. We continue to target strategic allocations in portfolios of 20% for alternative investments (and for endowment style investors, up to 45%). Within that allocation, private markets (including private equity) are typically allocated 7-9%, while hedge funds and real assets share the remaining 5-7% each.

When seeking to build a portfolio consisting of closed-end funds (with or without evergreen solutions), it is critical to build a road map from where your private markets portfolio is today to where you want it to be.

MSCI World buyout deal purchase price spread

Source: Hamilton Lane Data via Cobalt, Bloomberg, January 2022.

Source: Hamilton Lane Data via Cobalt, Bloomberg, January 2022.

So, how do we ensure vintage diversification in portfolios?

Understanding the theory and finding high quality investment managers is arguably easier than implementation. This is because fund structures are generally better suited to large institutions than private clients. To address this, there are two routes an investor should consider:

Significant innovation has occurred in recent years, enabling private clients to invest in highly diversified private market solutions in an open-end or ‘evergreen’ format. These solutions, typically developed by leading allocators of private capital, can address challenges around vintage diversification on behalf of investors. Such solutions offer a steady allocation to funds and investments of each vintage year, while also offering diversified exposures across manager, sector, geography and investment stage. Hamilton Lane’s Global Private Assets Fund and Partners Group’s Global Value Fund are core recommendations in our portfolios for this reason.

When seeking to build a portfolio consisting of closed-end funds (with or without evergreen solutions), it is critical to build a road map from where your private markets portfolio is today and where you want it to be. Frequently, we find portfolios heavily biased towards recent vintage years and concentrated in particular sectors or themes, which can be challenging should those vintages or sectors face periods of underperformance.

A good road map should include an appropriate commitment strategy, including an agreed level of annual commitments (and potential returns of capital) per vintage to reach your target invested allocation, as well as a clear idea of which areas of the market and managers you want to access in the years ahead. This can be more challenging than it sounds, which is why we typically recommend a combination of both evergreen and closed-end funds to ensure appropriate diversification and vintage continuity, whilst achieving target investment levels in the years ahead. Partnering with dedicated private markets specialists, such as Roc Partners (domestic) and Hamilton Lane (global), can greatly assist in developing and implementing that roadmap.

IMPORTANT NOTE This document has been prepared by Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (Crestone Wealth Management). The information contained in this document is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it.

Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document.

This document has been authorised for distribution in Australia only. It is intended for the use of Crestone Wealth Management clients and may not be distributed or reproduced without consent. © Crestone Wealth Management Limited 2022.