Reflecting this, we are making some adjustments to our regional equity allocations. Key considerations centre on relative exposures to the war in Ukraine and the vulnerability to elevated energy prices (including currency implications). They also reflect a desire to reduce our risk budget in a time of great uncertainty. Today, we are:

• Closing our equity overweight to Europe by moving underweight

• Increasing our exposure to the US (from underweight to neutral)

• Increasing our exposure to domestic equities (from neutral to overweight).

• We take both UK (overweight) and emerging market equities (underweight) to neutral.

Signs of easing inflation, or a pause in central bank tightening on the back of less buoyant leading indicators of growth, will be key to assessing future moves to add risk (or indeed, reduce it further).

On 24 January, we adjusted our tactical positions, reducing equity allocations from overweight to neutral as a result of stubbornly persistent inflation, accelerated central bank rate hikes, and rising geo-political risks. As we noted in our March Core Offerings, unusually, all these risks have intensified over the past six weeks. We remain comfortable with our high-level thesis that the global economy will continue recovering in 2022 and that inflation will eventually subside into mid-year, paving the way for solid equity market returns in the second half of 2022. To that end, we maintain our current preference for equities over fixed income returns, reflected by a tactically neutral position in equities, underweight in fixed income (both bonds and credit) and overweight to cash. We continue to look for an opportunity to add risk via equities, potentially during Q2 or around mid-year.

Despite this, the sanctions imposed on Russia (arguably more material than expected), and other supply-chain disruptions associated with the ongoing conflict, are likely to be enduring, even if a resolution to the situation in Ukraine is found in the near term. The most obvious impact of this has been (and will likely continue to be) felt in energy prices, which we now expect to remain elevated, even as geo-political tensions ebb and flow. We expect the resultant hit on consumers’ purchasing power to be more damaging to global growth than many are currently forecasting. As noted in the recent Crestone Investment Forum, “oil is nature’s interest rate”, and it appears central banks are going to have little choice but to begin a rate hiking cycle when real wage growth is negative and consumer purchasing power is being challenged. While consensus global growth estimates remain well above 4% for 2022, the impact of elevated oil and other commodity prices suggests forecasts are likely to be lowered over coming months closer to 3.5%.

Reflecting these concerns, we are making some adjustments to our regional equity market positioning. In making these changes, which are explained in more detail below, currency market moves are an important consideration. Since the initial Russian invasion of Ukraine, the Australian dollar has strengthened materially against the euro and the British pound. Additionally, our expectation is that elevated commodity prices (as well as a shift to a more hawkish stance from the Reserve Bank of Australia (RBA) in time) are likely to maintain upward pressure on the Australian dollar, reducing returns of unhedged foreign currency exposures. In addition to tilting towards markets less exposed to ongoing conflict in Ukraine we have, therefore, also reduced foreign currency exposure as a whole. Whether a region is a net energy importer or exporter has also been factored into our adjusted regional tilts.

At a regional level, our tactical shifts, in essence, reflect a desire to reduce our risk budget in a time of great uncertainty. The COVID -19 pandemic offered up numerous signposts that dictated the path of our equity exposures (e.g. fiscal and monetary stimulus, stabilisation in credit markets, vaccine success, mobility indicators etc.). In the current environment, the path forward is challenged by already very accommodative monetary positions, stretched fiscal budgets, very stressed commodity markets, and decelerating (yet still positive) growth and earnings. Clarity on these and other indicators will dictate the direction of equity markets. Until then, the appropriate course of action appears to be one focused on risk management, rather than a returns-based (i.e. buy-the-dip) mentality.

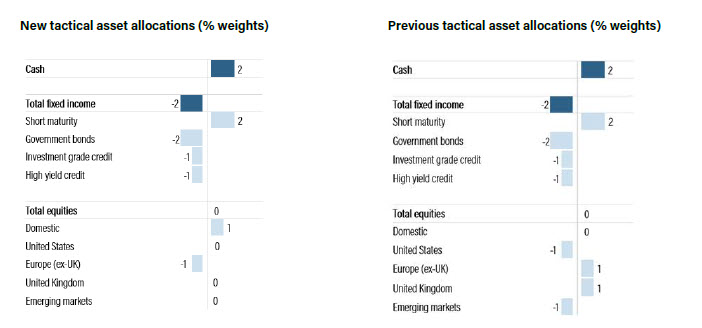

Consequently, we are making the following changes to reflect a further modest reduction in risk-taking. New and previous tactical asset allocation changes, as well as active portfolio weights, are shown in the tables below.

• Australia to overweight from neutral: This reflects Australia’s role as a net energy exporter, with likely continued upward appreciation of the Australian dollar. The latest reporting season was strong and valuations remain a full point below the five-year average (and in line with the 10-year average). Domestic equities should act as somewhat of a defensive exposure given yields, balance sheets, geographic distance from the Russia-Ukraine conflict and exposure to China, which is abandoning its zero-tolerance approach to COVID-19 and easing at the margin.

• The US to neutral from underweight: This reflects the US role as a defensive safe-haven during times of macro uncertainty, from both an equity market perspective and a US dollar perspective. We continue to acknowledge that rates are likely to initially rise faster in the US than in Europe or Australia which will be a headwind for equities, but there remains great uncertainty as to the velocity and ultimate end point for the Fed funds rate. The US is a net energy exporter and there is also more scope for revisions to interest rate pricing should growth slow or inflation pressures ease.

• Europe to underweight from overweight: Prior to the Russian invasion of Ukraine European equities had been outperforming the MSCI World index. Unfortunately, the addition of a significant geo-political risk premium and its implications for energy security, business confidence and monetary policy, has once again made investing in Europe difficult. The region’s lack of energy independence, in the main, could drive a sustained risk premium in key input costs, pressuring corporate margins and consumer confidence.

• UK to neutral from overweight: Until recently, the UK equity market had been one of the best performing developed markets globally. We continue to believe that the UK offers a multi-year investment opportunity and its index composition should remain broadly favourable, albeit the situation in Europe complicates the demand side of the equation. We believe that valuations remain suitably supportive for a neutral exposure, despite its proximity to Europe.

• Emerging markets to neutral from underweight: China is emerging from its zero-tolerance approach to COVID-19 and is easing at the margin, albeit the region continues to underperform materially. The latest China NPC also signalled a stronger higher target and greater fiscal support than expected. Emerging Europe will likely continue to be an underweight exposure. For Asia-Pacific equities, oil prices have historically been positively correlated, although oil supply shocks have been typically negatively correlated. Still, over time Asia is likely to benefit from its emergence from COVID-19, China is likely to become stronger, and the US dollar weaker.

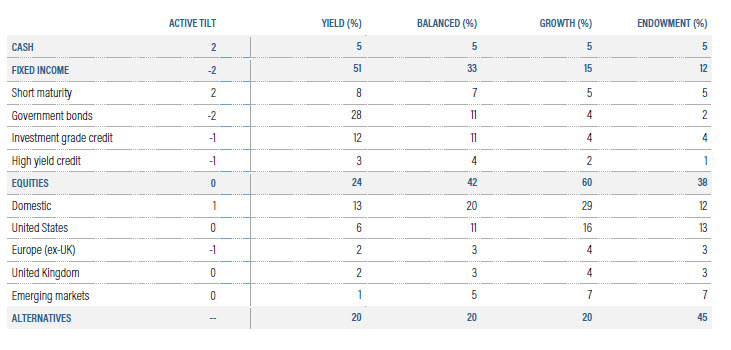

Source: Crestone Wealth Management. Units refer to the percentage point deviation from strategic asset allocations. Investment grade credit includes Australian listed hybrid securities.

Active portfolio weights and active tactical asset allocation tilts

IMPORTANT NOTE

This document has been prepared by Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (Crestone Wealth Management). The information contained in this document is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it.

Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document.

This document has been authorised for distribution in Australia only. It is intended for the use of Crestone Wealth Management clients and may not be distributed or reproduced without consent. © Crestone Wealth Management Limited 2022.