In April, LGT Crestone held its annual Investment Symposium in Brisbane, Melbourne and Sydney where leading experts discussed the increasing global volatility resulting from significant geo-political shifts and the revolutionary impact of artificial intelligence (AI) and the energy transition.

Scott Haslem, our Chief Investment Officer commenced the discussion with a macroeconomic and market update. This was then followed by our Senior Asset Allocation Specialist Matthew Tan who hosted a fireside chat with The Hon. Marise Payne and Director of Thought Leadership at the Future Fund Craig Thorburn on global political and geopolitical dynamics. In Brisbane, John Garnaut from Garnaut Global replaced Craig Thorburn from the Future Fund.

Our Head of Public Markets Todd Hoare then hosted a discussion on how competition in AI and technology is reshaping the economic and investment landscape. The panel also talked to opportunities in private markets namely within AI and the intersection of energy and sustainability. This panel featured insights from BlackRock’s Katie Petering, HarbourVest’s Scott Voss, and Munro Partner’s Nick Griffin. James Tsnidis replaced Nick Griffin from Munro Partner’s at the Brisbane symposium.

"Donald Trump was not elected to cause a global trade war or send the world into a deep recession," Scott Haslem, Chief Investment Officer, LGT Crestone

LGT Crestone’s Chief Investment Officer, Scott Haslem, believes that “growth is slowing but not collapsing, inflation is coming down and interest rates are being cut but will remain at more normalised levels”. Scott identified that volatility will be the constant companion over the coming period given Trump’s proposed tariffs and the new geopolitical era. Overarchingly, Scott expects ‘average-like’ returns over the coming year and despite the expected choppy periods ahead, he holds the view there will be some good buying opportunities by applying a constructive portfolio approach.

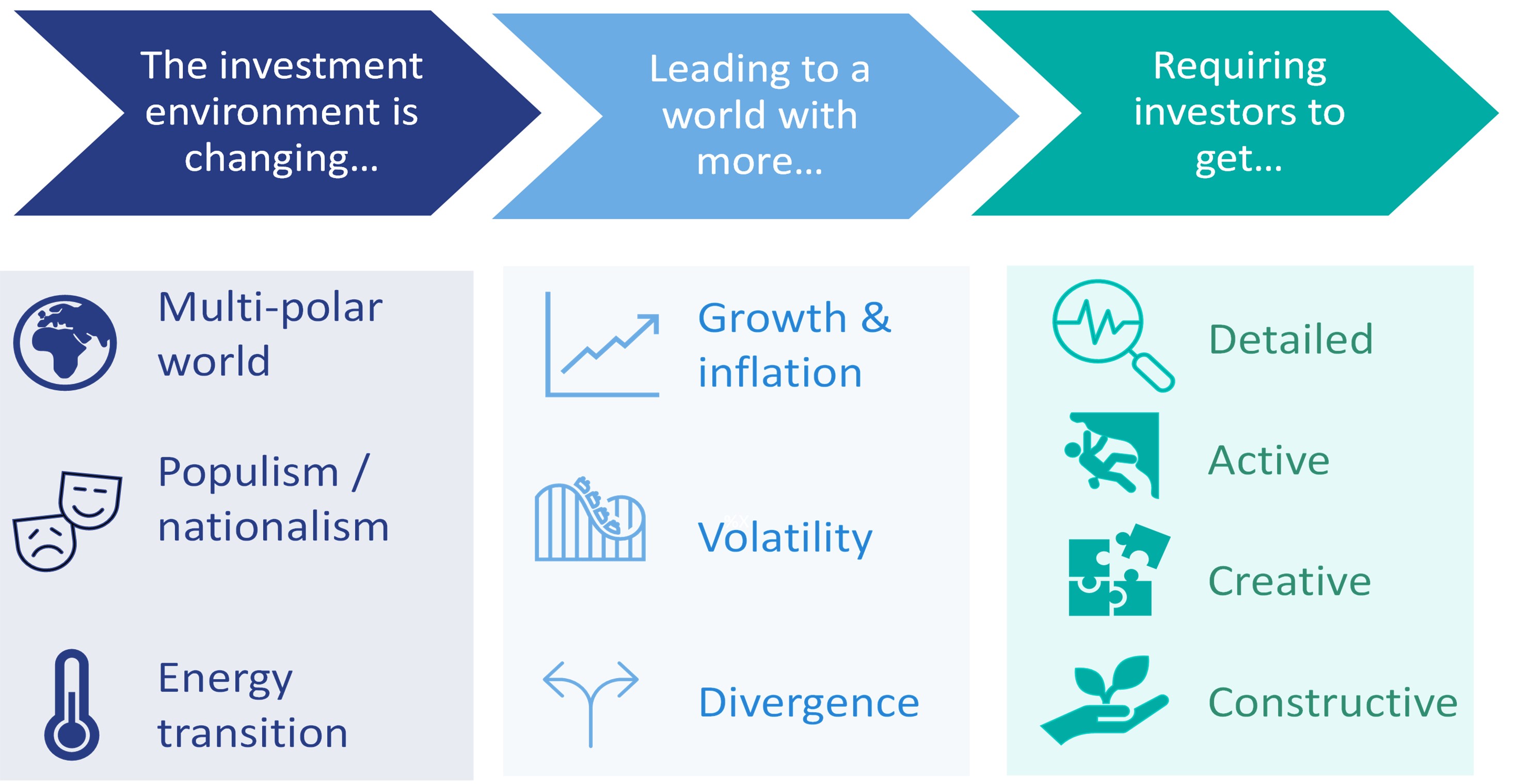

LGT Crestone’s Secular outlook applies a ‘secular lens’ to navigate the portfolio through geopolitics and expected volatility:

Source: LGT Crestone, CIO Office

Scott expects a high level of volatility over the coming period, consequently, he sees two risks to the team’s ‘constructive outlook’.

The first being a sharp slowdown in global growth which could result from Trump’s Liberation Day tariffs. Scott reminded investors that ‘tariffs are not necessarily about tariffs’ in the case of President Trump. He holds the view that it’s more about President Trump’s agenda for tax cuts which is what he was voted in for by the American public, “Donald Trump was not elected to cause a global trade war or send the world into a deep recession”. Scott referred to the three tools at his disposal to deliver tax cuts:

1. Tariffs—revenue source

2. Department of Government Efficiency (DOGE)—reducing expenditure

3. Lower rates—lower US debt bill.

Scott outlined how Trump wants to lower interest rates but a key mandate of US Fed Chair Powell is to lower inflation. Scott foresees a ‘game of chicken’ with the Fed with Trump being the overall winner. Scott acknowledged that tariffs are likely to initially put some short-term upward pressure on prices and inflation “it’s mathematically likely, as tariffs are paid by importers who at the very least will try to pass through to consumers”.

Scott however highlighted that tariffs can in fact be deflationary as they are a tax on the consumer. Scott demonstrated consumers have to pay more for something, so they spend less on other things, slowing demand. In the current environment, he expects the heightened level of uncertainty (geo-political and trade) is also weighing on business and consumer demand. He expects businesses are likely to absorb some, reducing profit and thus reducing investment and employment.

All things being equal, he pointed out that once the initial impact of tariffs has occurred, it drops away one year later “yes, it sits in the annual measure of inflation...but central banks and the market are smarter than that and will discount that in favour of the monthly inflation data and focus on the price impulse in the monthly data”.

He believes that Trump is using tariff’s to ‘force the Fed’s hand’ to reduce rates. The tug of war between fiscal policy (ie tariffs and taxes) and monetary policy (ie the pace and size of potential rate cuts) adds considerable uncertainty to the outlook but its outcome is nonetheless important for the direction of asset pricing.

This leads into his second risk which is that growth will significantly slow down. He refers to the recent GDP numbers, “it looks like the 1Q25 GDP is going to be flat after a couple of quarters of almost 3% growth”. He sees this as a risk given the ‘fairly benign’ backdrop for global growth. Scott points out is that in this scenario this may see the Fed cut rates which should stabilise markets.

Putting aside the current ‘cyclical’ environment (where demand is weakening), he retains a long held view that inflation will over the next few years be ‘structurally’ higher. He will continue to expect a higher resting rate for both inflation and interest rates relative to the past decade.

Scott and his investment team will rely ‘on the courage of their conviction’ and look to ‘buy the dips’ when they present themselves. The team will focus on:

Diversification and active management will be imperative to the team’s multi-asset strategy, to not only protect the portfolio during expected times of volatility but provide buying opportunities when they open over the coming 12 months.

"These various developments lead you to think we must be living in a multipolar world, no matter how all consuming the US-China relationship is," The Hon. Marise Payne, former Minister for defence and foreign affairs.

It is LGT Crestone’s view that we are now in a more complicated multi-polar world. This geopolitical backdrop is characterised by multiple great powers all interacting and pursing their own unique goals and objectives at the same time, as opposed to a bi-polar environment à la the Cold War or the remarkably stable uni-polar Pax Americana period of the 1990s. This new order will have significant implications for economies and financial markets.

We invited two key thinkers and practitioners: Marise Payne, who became Australia's first female Minister for Defence in 2015 before taking on the role as Minister for Foreign Affairs in 2018 and Craig Thorburn, Director of Partners and Insights at the Future Fund, Australia's sovereign wealth fund, to help guide us through what seems to be an increasingly uncertain world. The Hon. Marise Payne spoke to the significant changes seen in the global environment over the past 10 years, noting that in 2015, counter-terrorism priorities and foreign interference were the primary concerns of policymakers, “Remember 2015? Terrorism was the most significant threat in a strategic sense that the Western world was confronting. The second most important regional issue that we were addressing at the time was [North Korea’s] threats to the Republic of Korea”. Marise commented on how hard she and her colleagues had worked during the first Trump administration to have a very effective relationship between Australia and the United States.

The world has since seen Russia invade Ukraine in 2022 and Hamas attack Israel in 2023 which Marise noted does mean that we are currently in a multi-polar environment, with multiple countries having a significant influence on global affairs, notwithstanding how all-consuming the US-China relationship is.

Looking at Trump 2.0 and the current geo-political backdrop, she commented that President Trump will inevitably spend time on Ukraine and Russia and Israel and Gaza, notwithstanding the primacy of the US-China relationship. Commenting on the US political environment, she said “I expect there will be great unity (in the Congress) on the China challenge. And the Trump administration will inexorably move towards addressing that”.

Craig Thorburn from the Future Fund further asserts that the “bedrock of the new investment order is geo-politics” and that ‘this order’ is very different to what the world has seen since the 1980s. This shift is resulting in a different complexion of risks which requires different thinking. One of the Future Fund’s key views is that investing in the traditional (60% equities and 40% bonds) investment portfolio will not likely get you the returns you are aiming for going forward.

He then refers to ‘four drivers’ that are likely to make geopolitics a more relevant frictional influence today and into the future:

1. Changing trade dynamics: governments are now prioritising economic resilience—under the guise of national security—over national efficiency. Craig refers to the global pandemic acting as a catalyst for this change, noting that complex supply chains were seen as a source of economic vulnerability, “several countries are now ‘onshoring’ or ‘friend-shoring’ critical industries such as semiconductors and implementing trade barriers.

2. Rise in strategic competition: rising strategic competition globally is seeing countries putting policies in place that are throwing ‘sand in the gears’ of the global economy across aspects including labour, goods and capital. Craig points out that strategic competition and the blurring of growth or economic security with national security has accelerated in recent years.

3. Rise of populism: Craig comments that many citizens across the world are becoming disillusioned with major political parties, resulting in growing populist pressures for more active fiscal policy to address societal inequities, “history will tell you that these dynamics can lead to suboptimal policy outcomes. And unfortunately, what that leads to is growth of inefficiency in marketplaces. And that's a world we are trending to”.

4. Rising conflict: Craig points out that most investors aren’t very good at predicting conflict, “and I would suggest you probably shouldn't, because a lot of people have probably had some graveyards in their investing life by trying to predict an outcome of a conflict. We don't try and predict that outcome”.

"We've made over $100 billion in structural changes to increase the resilience of our portfolios as part of our response to this changing investment order,"

Craig Thorburn, Future Fund, April 2025.

Assessing the potential impact of the above drivers is difficult however Craig points to having a longer-term mindset “it’s about trying to see which assets, sectors and economies, and regions are winners or losers over the long-term”. He also believes in focussing on geo-political developments that are likely to occur over the horizon.

Craig states that the Future Fund has “increased its structural appetite for investment risk” to achieve its mandate noting that concerns of a US downturn had receded in recent months, although it remains vigilant given broader geopolitical concerns. “And so we felt okay, even with all these other geopolitical risks that I’ve referred to, [taking on additional structural] risk in order to achieve our mandate”. This is consistent with the LGT Crestone house view around a more growthier secular outlook.

The Future Fund has made significant changes to their portfolio in response to its secular outlook with a focus on resilience to inflation by tilting its portfolios towards owning inflation linked asset classes, gaining exposure to the energy transition and technology (including AI), adding gold to its currency basket, and reviewing the role of government bonds as a diversifying asset class. The Future Fund’s view is that hedge fund strategies may play a more robust diversifying role going forward.

At the symposium, Matt spoke to LGT Crestone’s belief that a more complicated, volatile world should present a richer opportunity set for high quality active managers to add value to portfolios.

In February 2025, Matthew Tan, Senior Asset Allocation Specialist at LGT Crestone wrote an Observation piece titled The New Great Game—Investing in a multi-polar world. Some key messages from this report include:

More specifically, Matt discussed how LGT Crestone is tilting its portfolios heavily towards secular growth opportunities around infrastructure, AI and the energy transition-related investments, across both equities and in alternatives.

He further spoke to his increased conviction in global equities relative to Australian equities and the valuable diversifying qualities of foreign currency exposure, “we are focusing on a ‘total portfolio approach’ to currency management to maximise the currency benefits of the Australian dollar”.

"We’ve always been of the view that AI will have a profound impact, not just on our lives but in terms of global economy….it is something that genuinely helps me sleep at night," Craig Thorburn, Future Fund

Most investors are either interested in investing in Artificial Intelligence (AI) or asking themselves how AI is impacting and influencing their investments.

Our Head of Public Markets Todd Hoare hosted a discussion on how managers are investing in key trends—AI and the intersection of energy and sustainability in the current investment climate. The panel featured insights from three of our top portfolio managers including, BlackRock’s Katie Petering, HarbourVest’s Scott Voss, and Munro Partner’s Nick Griffin.

Nick Griffin, founder and Chief Investment Officer of Munro Partners opened the panel discussion by highlighting that the current AI thematic “is just like the mobile phone revolution” that began almost 20 years ago with the launch of the iPhone Using this parallel, Nick talked to the uniqueness of the smartphone revolution, in that it was a combination of hardware (actual phone and micro-chips) and applications that sat on top of the device, which allowed investors multiple avenues for investment. The hardware winners were companies such as Apple, semiconductor providers and the application winners included Google, Facebook, Uber, Spotify etc.

Just as the smartphone revolution created multiple investment avenues and ‘winners’ and ‘losers’, Nick believes AI is going to do the same. He believes the hardware winners are relatively easy to work out. In his opinion that is American-listed AI computing and technology company Nvidia (NYSE: NVDA)”. Significantly, however, Nick spoke to how Nvidia is both a hardware and software winner. Other hardware winners include cloud service providers and cloud data centres which are driving AI capex.

Nick believes that the large energy requirements associated with the development and use of large language models will mean electricity providers will also be winners. Nick also gets excited about the possibilities for AI applications and spoke to the fact Uber was created five years after smartphones were created as an example of how we are in the early innings of discovery when it comes to AI use cases, “the cool thing about AI is that it’s going to affect everything, not just consumer applications—this extends to drug discovery, healthcare and how we construct buildings”.

Todd from LGT Crestone then highlighted how the recent development of DeepSeek is seemingly fast-tracking the ‘democratisation of AI’, in that its lower cost and open-source nature could see an increase in demand. More specifically, he referenced ‘Jevons Paradox’, which as Nick succinctly put “the more you use the more you end up using”, as seen with semiconductors. Nick points out that “the iPhone revolution wouldn’t have happened if we didn’t lower the price of semiconductors which then allowed more of us to buy one (a smartphone) and the applications got better because we could afford to buy them”.

"We could talk valuations, we could talk AI democratisation, we could get into software," Todd Hoare, Head of Public Markets, LGT Crestone.

Scott Voss, Managing Director and Senior Market Strategist from HarbourVest spoke to the growing opportunities in private markets as opposed to listed. Scott highlights that companies in this space are choosing to stay private longer instead of listing and “if you want to participate in that type of opportunity, you need a private market allocation in your portfolio”. Scott highlighted that venture-backed companies used to IPO at around US$500 million valuations but now in the venture-backed AI space, for example, if these companies choose to list, it would now be with a market capitalisation that could be in the range of US $50–100 billion. Scott highlights that one of the advantages of venture backed capital is that you can invest narrowly in AI, if desired, but the portfolio-based approach allows for significant diversification across applications, industries, countries and access vehicles.

"If you want to participate in that type of opportunity, you need a private market allocation in your portfolio," Scott Voss, Managing Director and Senior Market Strategist, HarbourVest.

“The venture model is generally where 10% of your investments drive 90% of your returns” but as Scott points out, “if you’re participating in those companies that matter, those 10%, whether it’s AI, Anthropic PBC or a SpaceX, those companies a returning hundreds of times capital for investors”.

Katie Petering, Head of Investment Strategy for multi-asset strategies and solutions in Australasia from BlackRock then spoke on how the world’s largest asset manager (approximately US$11.5 trillion assets under management) is investing in AI. Katie, specifically spoke to the BlackRock AI Labs which was developed over 10 years ago. According to Katie, the initiative employs the best and brightest minds to solve enterprise-level problems for BlackRock and its portfolios in terms of the way they approach portfolio construction, “this is looking at dynamics in trading and ETFs, portfolio optimisation, machine learning”.

Katie highlights that by utilising Blackrock AI Labs, portfolios are now able generate ‘idiosyncratic’ alpha (elements of return which cannot be easily replicated).

From an investing perspective, Katie highlighted that Blackrock are looking to remain ‘granular’ with their asset allocations, seeking uncorrelated exposures that are consistent with some of their mega-trends (e.g. AI, the energy transition, structurally higher inflation). Generally, Blackrock’s return expectations from a simple index portfolio is a lot lower than it used to be. As multi-asset investors, they are seeking add more return but “also more ballast for that volatility.

"The beneficiaries of the AI build and adoption are where we are trying to place our bets," Katie Petering, Head of Multi-Asset Strategies, BlackRock.

The world is currently undergoing an ‘energy transition’ that is, a shift from fossil fuels to less carbon intensive energy sources.

Nick from Munro Partners believes that the demand for AI, electric vehicles, data centres and new technologies will require more electricity to powers, “the world’s going to need a lot more energy to power this stuff”. Decarbonisation and the shift away from fossil fuels will be expensive from an investment perspective, but Nick highlights he and his team at Munro are looking to “follow the money”—that is, where are the largest investments needed to achieve this transition. In this respect, he referenced Munro’s investment in American energy company, Constellation Energy (CEG) and Schneider Electric (SU), which manufactures electrical power products. Nick discussed how nuclear is the largest source of carbon-free energy but that the cost of new builds in western economies is prohibitive and lengthy. Consequently, with existing nuclear fleets trading well below their replacement costs, he believes incumbent nuclear energy companies are an attractive investment opportunity.

Katie from BlackRock discussed how the energy transition is playing an important part in how they think about portfolios, referring to it as one of BlackRock’s ‘mega forces’ which in turn influences another of their mega forces, that inflation will be structurally higher than what it has been over the past 10–20 years. From an asset allocation perspective, the intersection of these mega trends is seemingly reshaping the traditional 60/40 portfolio (60% equities and 40% bonds). We're in a completely new regime, and the 60–40 portfolio does not deliver the same returns it did before COVID”.

"The world’s going to need a lot more energy to power the meet the demand for AI, electric vehicles, data centres and new technologies," Nick Griffin, Founding Partner & Chief Investment Officer, Munro Partners.

IMPORTANT NOTE

This article has been prepared by LGT Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Crestone Wealth Management). The information contained in this article is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this article, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it.

Although the information and opinions contained in this article are based on sources we believe to be reliable, to the extent permitted by law, LGT Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

LGT Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this article. The LGT Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this article. To the extent possible, the LGT Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this article.

This article has been authorised for distribution in Australia only. It is intended for the use of LGT Crestone Wealth Management clients and may not be distributed or reproduced without consent. © LGT Crestone Wealth Management Limited 2025.

Please note, views are current at the time of the LGT Crestone Symposium on 1 April 2025 and are subject to change.