Ever since the release of the Australian Prudential Regulation Authority’s (APRA) letter in early November 2022 regarding its expectations on capital calls, the market has had one eye on the pending call of the Westpac Banking Corp (WSTP) February 2023-28 line.

With global credit spreads widening over the past 12 months, APRA’s letter reinforced existing prudential requirements for Additional Tier 1 (AT1) Capital or Tier 2 (T2) Capital, in an attempt to deter ‘uneconomic calls’ from being made. Its prudential standards require that issuers should not call AT1 or T2 capital and replace it with an instrument with a higher credit spread, as it may create the expectation that the issuer will exercise a call option on other outstanding AT1 and T2 capital instruments with call options.

In this Special report, we look at how the market has reacted to the recent WSTP call, the lack of recent Australian dollar denominated T2 supply, and why a new subordinated T2 deal should be well receivedby the market.

Not only is WSTP the first major bank with a call date following the letter’s publication, but it also has the lowest coupon of any call in the next three years (BBSW +140 basis points (bps)). This means it has been seen by some as a test of APRA’s stance following the letter’s publication.

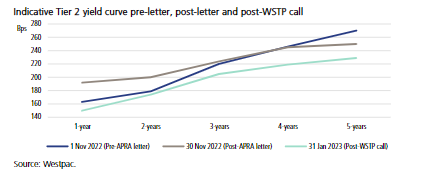

The call notice could be issued any time from 2 January 2023, so many had expected it to be called in early January together with a new deal. By 27 January, investors became uneasy as there was no news on the call, and the momentum of tightening spreads started reversing. On 27 January, the Australian Securities Exchange issued a notice that APRA had approved the call, thereby removing concerns around extension risk. This triggered a rally in spreads, as well as a material re-steepening of the curve (e.g. WSTP June 2023-28 securities tightened 75bps). The chart below shows the indicative T2 curve pre-letter, post-letter, and post-WSTP call. As at 2 February, the WSTP call has unwound roughly half of the curve steepening (e.g. the one to five-year part of the yield curve flattened from 107bps to 58bps and is now back to 80bps).

Westpac is the first major bank with a call date following APRA’s letter and has the lowest coupon of any call in the next three years. This means it has been seen by some as a test of APRA’s stance following the letter’s publication.

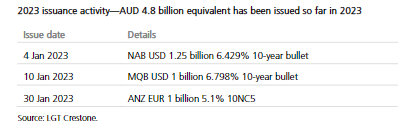

Combined with the fact that Australian dollar denominated T2 spreads are now as tight as they were in May 2022, it is surprising there has been no primary supply in Australian dollars since October. There have, however, been three foreign currency denominated T2 deals in January, with National Australia Bank and Macquarie issuing 10-year US dollar bullets to avoid extension risk.

Although Australian dollar denominated T2 spreads are now as tight as they were in May 2022, it is surprising there has been no primary supply in Australian dollars since October 2022.

Since the WSTP call notice, ANZ has issued the first callable structure since the APRA letter—a EUR 1 billion 10 Non-Call 5, which was well received and raised over EUR 3.5 billion. This deal swapped back to BBSW +280bps (approximately 30-40bps tighter than where an Australian dollar-denominated 10 Non-Call 5 would be expected to print).

At the start of January, existing Australian dollar fixed rate T2 debt was trading around 15bps tighter than equivalent floating rate note tranches. However, over the course of the month this contracted all the way back to flat. The contraction was likely driven by the large move in outright yields. The market’s pricing of the Reserve Bank of Australia’s terminal cash rate fell from 4% at the start of January to 3.6% following weak employment numbers on 19 January. Outright yields have retraced some of this move in recent days, so it will be interesting to see if this flows through to increased demand for fixed tranches. The Commonwealth Bank of Australia’s T2 deal in November was split almost 50/50 fixed/floating, while the three deals predating this were predominantly fixed rate.

While private banks have been buyers of T2 debt due to attractive outright yields, institutional investors have been selling T2 to make way for new supply. Based on data supplied to us by Westpac, in January, private banks bought almost five times more T2 than they sold, while institutional investors sold almost five times more than they bought. Westpac believes that institutional investors were likely ‘saving their bullets’ for anticipated primary supply in January which ultimately never eventuated. Private banks, on the other hand, have smaller but more regular interest that is spread out over time and better suited to buying in secondary markets rather than large blocks in primary markets.

We are hoping to see new T2 supply in February, with a new issue from WSTP most anticipated.

The combination of higher outright yields (driven by nine consecutive rate rises from the Reserve Bank of Australia) and higher T2 spreads (driven by total loss-absorbing capital requirements) have led to yields of more than 6.00% in subordinated T2. For this reason, coupled with tightening spreads for BBB-rated corporates, we believe this sector will continue to attract investors searching for yield in the investment grade space. A new Australian dollar deal would be very well absorbed and may not have the new issue concession that many are hoping for. We are hoping to see new T2 supply in February, with a new issue from WSTP most anticipated, as it has been noticeably absent from the market. Based on today’s pricing, a new subordinated T210 Non-Call 5 issue for a major bank, such as WSTP, would come at a spread of BBSW +240bps area, a yield to call of 6.06% on a fixed rate coupon.

| Bank | Planned | Issued | Remaining |

| ANZ | 6 | 1.5 | 4.5 |

| CBA | 4.5 | - | 4.5 |

| NAB | 4.5 | 1.8 | 2.7 |

| WSTP | 4.5 | - | 4.5 |

| MQB | 1.5 | 1.5 | - |

| Total | 21 | 4.8 | 16.2 |

Source: UBS

| ISIN | Ticker | Mid TM | Tenor | Call | Coupon |

| AU3FN0040754 | WSTP F T2 02/23-28 | 130 | 0.04 | Feb-23 | 140 |

| AU3FN0043238 | WSTP F T2 06/23-28 | 135 | 0.39 | Jun-23 | 180 |

| AU3FN0048195 | NAB F T2 24-29 | 160 | 1.29 | May-24 | 215 |

| AU3FN0049128 | ANZ F T2 24-29 | 160 | 1.48 | Jul-24 | 200 |

| AU3FN0049672 | WSTP F T2 24-29 | 160 | 1.57 | Aug-24 | 198 |

| AU3FN0055992 | CBAAU F T2 25-30 | 194 | 2.61 | Sep-25 | 180 |

| AU3FN0057402 | NAB F T2 25-30 | 198 | 2.80 | Nov-25 | 170 |

| AU3FN0058129 | WSTP F T2 26-31 | 205 | 3.00 | Jan-26 | 155 |

| AU3FN0055687 | ANZ F T2 26-31 | 208 | 3.07 | Feb-26 | 185 |

| AU3FN0062600 | CBAAU F T2 26-31 | 216 | 3.55 | Aug-26 | 132 |

| AU3FN0051587 | NAB F T2 26-31 | 218 | 3.80 | Nov-26 | 202 |

| AU3FN0067989 | CBAAU F T2 04/27-32 | 221 | 4.20 | Apr-27 | 190 |

| AU3FN0070199 | NAB F T2 27-32 | 223 | 4.51 | Aug-27 | 280 |

| AU3FN0070330 | ANZ F T2 27-32 | 223 | 4.53 | Aug-27 | 270 |

| AU3FN0073029 | CBAAU F T2 11/27-32 | 227 | 4.78 | Nov-27 | 270 |

Source: Westpac

Latest Pricing for domestic major bank T2 fixed rate debt

| ISIN | Ticker | Mid ASW | Mid Yield | Tenor | Call | Reset |

| AU3CB0268423 | NAB 3.225 T2 26-31 | 203 | 5.79% | 3.80 | 18-Nov-26 | 202 |

| AU3CB0288389 | CBAAU 4.946 T2 04/27-32 | 207 | 5.75% | 4.20 | 14-Apr-27 | 190 |

| AU3CB0290039 | MQGAU 6.082 T2 27-32 | 228 | 5.92% | 4.35 | 7-Jun-27 | 270 |

| AU3CB0291284 | NAB 6.322 T2 27-32 | 213 | 5.75% | 4.51 | 3-Aug-27 | 280 |

| AU3CB0291466 | ANZ 5.906 T2 27-32 | 220 | 5.85% | 4.53 | 12-Aug-27 | 270 |

| AU3CB0292324 | CGFAU 7.186 T2 27-37 | 307 | 6.71% | 4.63 | 16-Sep-27 | 355 |

| AU3CB0293769 | CBAAU 6.86 T2 11/27-32 | 226 | 5.87% | 4.78 | 9-Nov-27 | 270 |

| AU3CB0292472 | ANZ 6.405 T2 29-34 | 221 | 6.00% | 6.64 | 20-Sep-29 | 260 |

Source: Westpac

| ISIN | Ticker | Mid TM | Tenor | Call | Coupon | vs Major |

| AU3FN0042339 | BQDAU F T2 23-28 | 220 | 0.25 | May-23 | 185 | 80 |

| AU3FN0045746 | AMPAU F T2 23-28 | 365 | 0.79 | Nov-23 | 275 | 214 |

| AU3FN0046066 | BENAU F T2 23-28 | 200 | 0.83 | Nov-23 | 245 | 48 |

| AU3FN0044251 | SUNAU F T2 23-28 | 180 | 0.84 | Dec-23 | 215 | 28 |

| AU3FN0041687 | IAGAU F T2 24-44 | 257 | 1.38 | Jun-24 | 210 | 94 |

| AU3FN0054284 | MQGAU F T2 25-30 | 216 | 2.32 | May-25 | 290 | 34 |

| AU3FN0047544 | IAGAU F T2 25-45 | 269 | 2.38 | Jun-25 | 235 | 85 |

| AU3FN0057410 | BENAU F T2 25-30 | 245 | 2.80 | Nov-25 | 195 | 53 |

| AU3FN0055802 | SUNAU F T2 25-35 | 245 | 2.84 | Dec-25 | 225 | 52 |

| AU3FN0057691 | AMPLF F T2 25-35 | 390 | 2.86 | Dec-25 | 330 | 197 |

| AU3FN0061065 | MQGAU F T2 26-31 | 237 | 3.38 | Jun-26 | 155 | 33 |

| AU3FN0060091 | BQDAU F T2 26-31 | 285 | 3.49 | Jul-26 | 160 | 79 |

| AU3FN0055489 | QBEAU F T2 26-36 | 267 | 3.57 | Aug-26 | 275 | 59 |

| AU3FN0063467 | BENAU F T2 26-31 | 287 | 3.70 | Oct-26 | 148 | 76 |

| AU3FN0055497 | IAGAU F T2 26-36 | 263 | 3.87 | Dec-26 | 245 | 49 |

| AU3FN0064408 | BQDAU F T2 27-32 | 291 | 4.30 | May-27 | 175 | 68 |

| AU3FN0067906 | SUNAU F T2 27-37 | 269 | 4.33 | Jun-27 | 230 | 46 |

| AU3FN0069381 | MQGAU F T2 27-32 | 249 | 4.35 | Jun-27 | 270 | 25 |

| AU3FN0072161 | AMPAU F T2 27-32 | 388 | 4.68 | Oct-27 | 465 | 157 |

Source: Westpac

This document has been authorised for distribution to ‘wholesale clients’ and ‘professional investors’ (within the meaning of the Corporations Act 2001 (Cth)) in Australia only.

This document has been prepared by LGT Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Crestone Wealth Management). The information contained in this document is provided for information purposes only and is not intended to constitute, nor to be construed as, a solicitation or an offer to buy or sell any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your ‘Personal Circumstances’). Before acting on any such general advice, LGT Crestone Wealth Management recommends that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the product before making any decision about whether to acquire the product.

Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, LGT Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

LGT Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document.

Credit ratings contained in this report may be issued by credit rating agencies that are only authorised to provide credit ratings to persons classified as ‘wholesale clients’ under the Corporations Act 2001 (Cth) (Corporations Act). Accordingly, credit ratings in this report are not intended to be used or relied upon by persons who are classified as ‘retail clients’ under the Corporations Act. A credit rating expresses the opinion of the relevant credit rating agency on the relative ability of an entity to meet its financial commitments, in particular its debt obligations, and the likelihood of loss in the event of a default by that entity. There are various limitations associated with the use of credit ratings, for example, they do not directly address any risk other than credit risk, are based on information which may be unaudited, incomplete or misleading and are inherently forward-looking and include assumptions and predictions about future events. Credit ratings should not be considered statements of fact nor recommendations to buy, hold, or sell any financial product or make any other investment decisions.

This document has been authorised for distribution in Australia only. It is intended for the use of LGT Crestone Wealth Management clients and may not be distributed or reproduced without consent. © LGT Crestone Wealth Management Limited 2023.